The videos show you how to add accounts and includes charts to help you gain a quick understanding of money flows into / out of the accounts. Set up your accounts to match descriptions applicable to you.

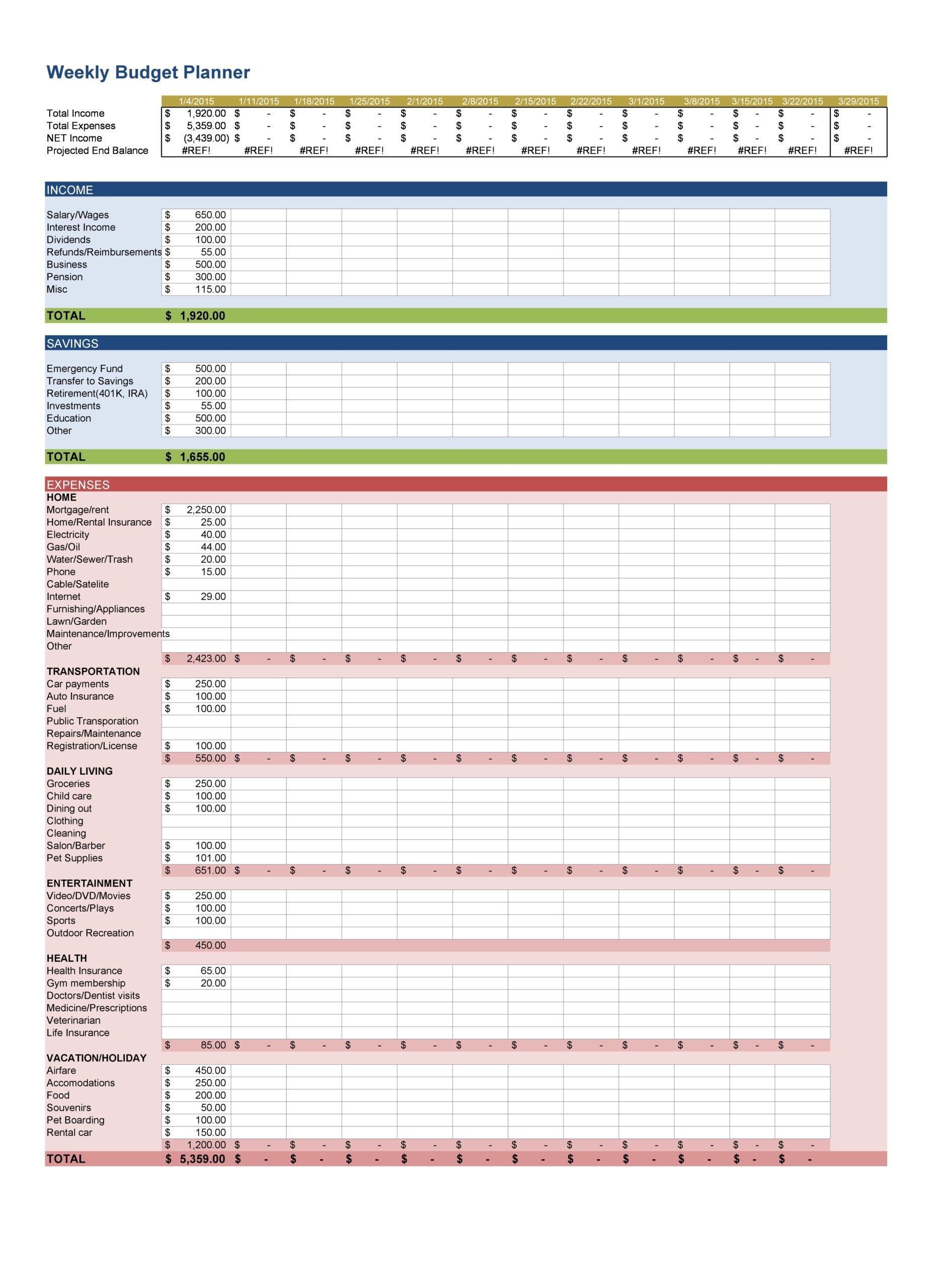

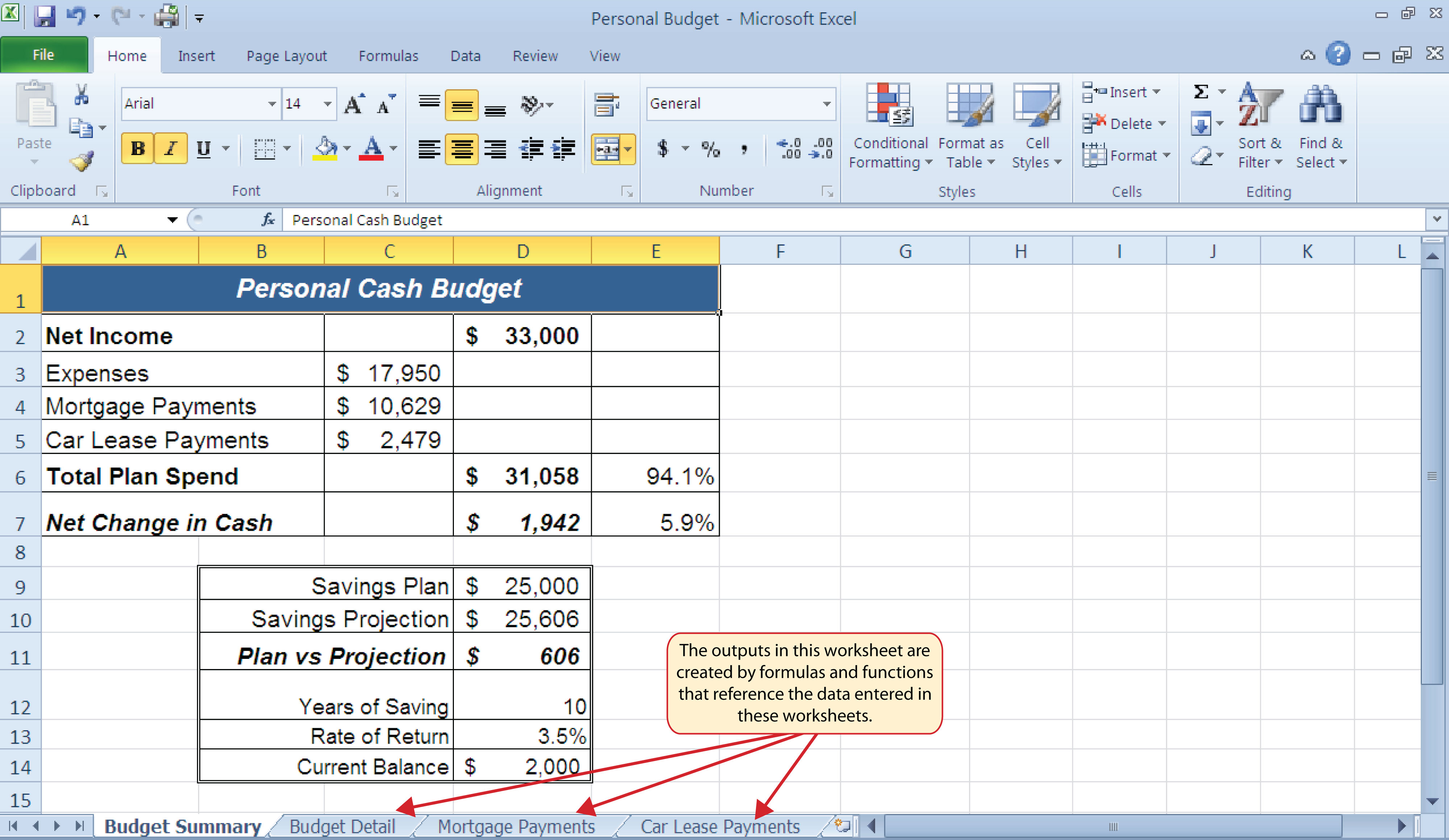

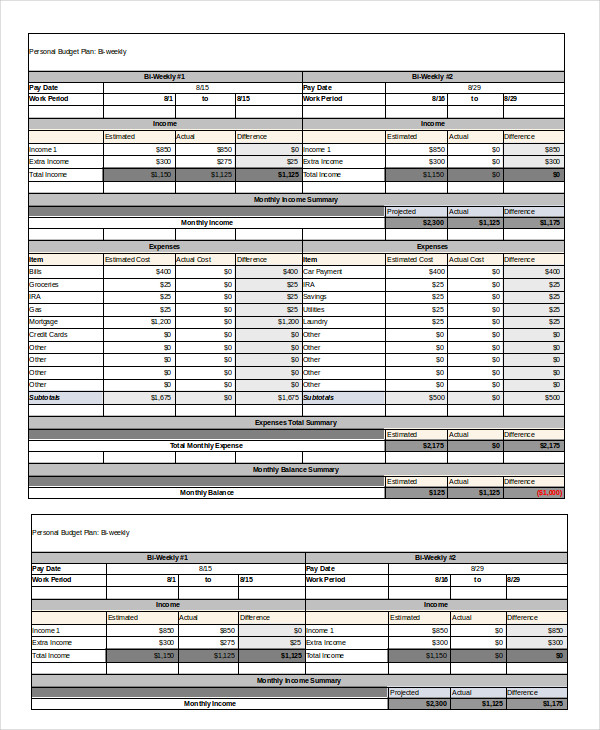

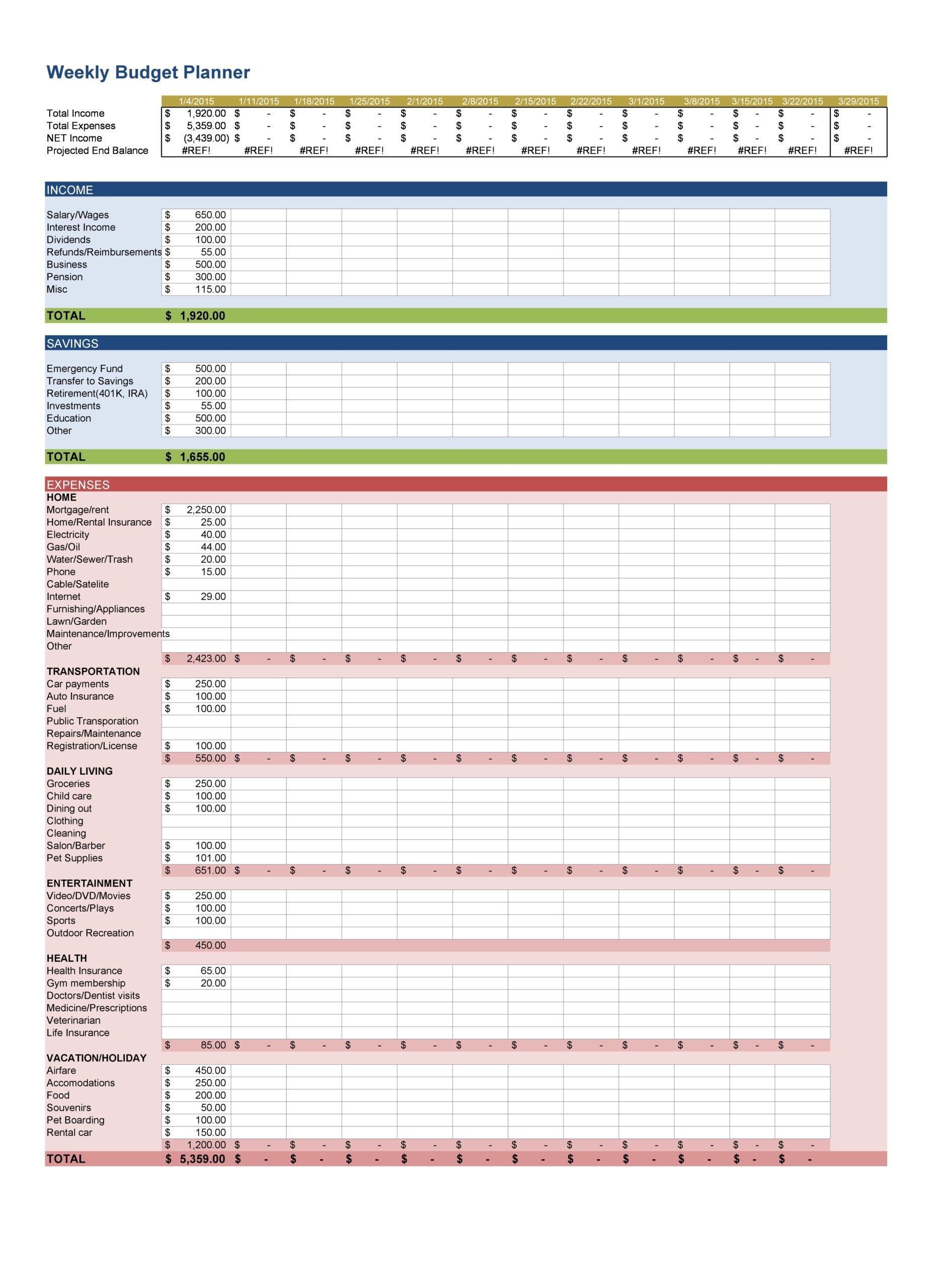

The videos walk you through how to accomplish this. The tool is flexible, allowing you to add headings that make sense for your budget. The course shows you how to eliminate expenses that you do not want to focus on (typically costs that will not change much soon) so you can look closer at areas that you can modify to hopefully reduce. At the touch of a button, update statistics of the selected date ranges to see where your money is going. Duplicate the previous month’s expenses at the touch of a button, then customize as needed.Įasy-to-use analysis tools are included to help you focus on where your money is going so you can see where cutbacks can be made and put those dollars to better use. Within the first sheet, you will find three sections, including income, savings and expenses. This template is made up of two sheets, one for your budget breakdown and the second is your dashboard. Customizing the expenses of each month are easy with this spreadsheet. Begin by downloading the personal budget template, and inputting your income, savings goals, and expense amounts for the first month. If you are stuck on what to do, read the articles on formulas and functions, and Visualizing data using charts in Excel.NOT JUST ANOTHER BUDGETING SPREADSHEET. Use conditional formatting to change the text colour to red if the variance is less than 0 else change the text colour to green.

For a quick and easy budgeting tool in community languages with. Use the IF functions to display “You need to work extra hard to meet your income targets” if the variance is less than zero (0) else display “Great job working smart and harder”. Use our Excel spreadsheet version if you want to access your budget across multiple devices.

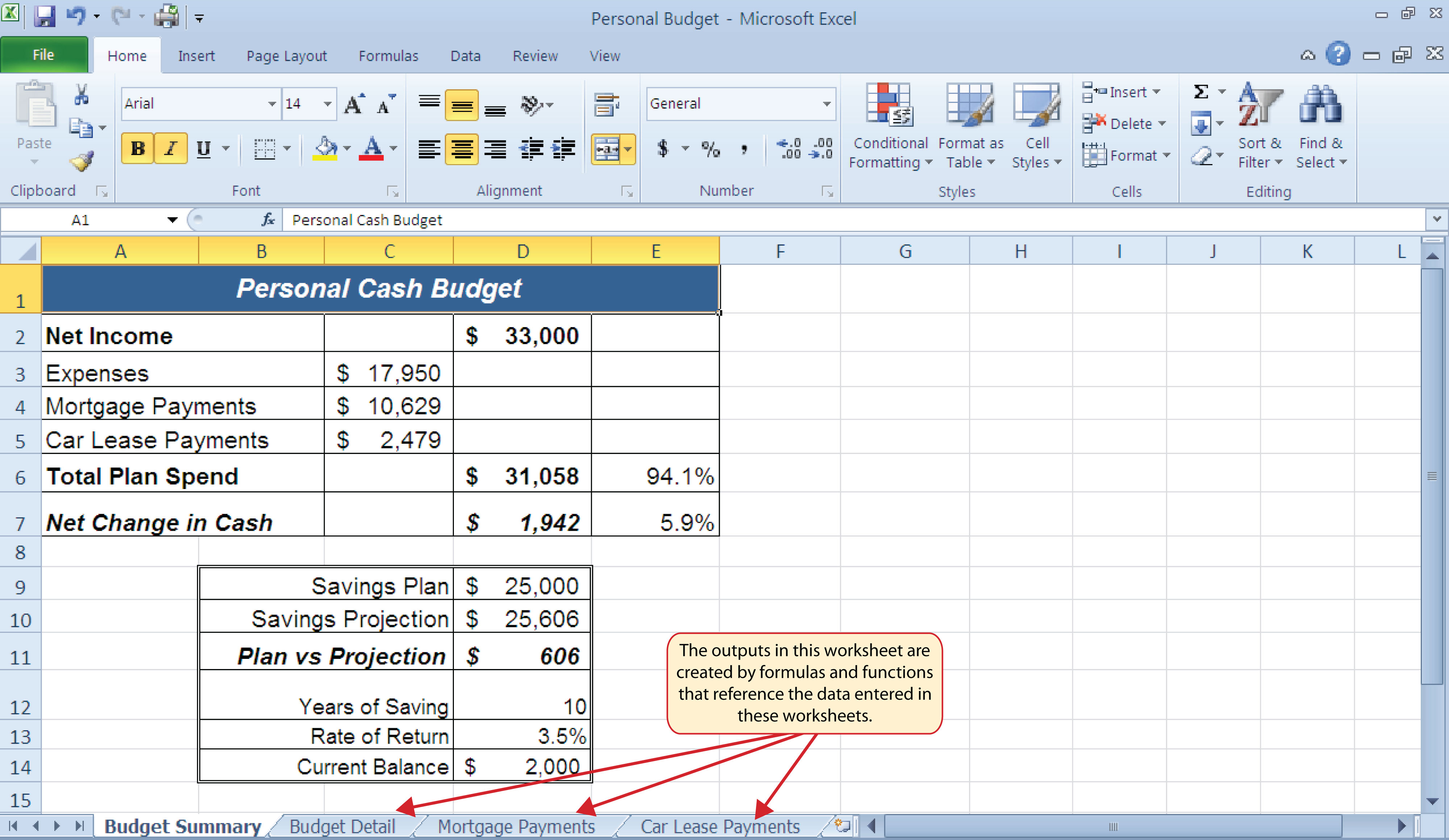

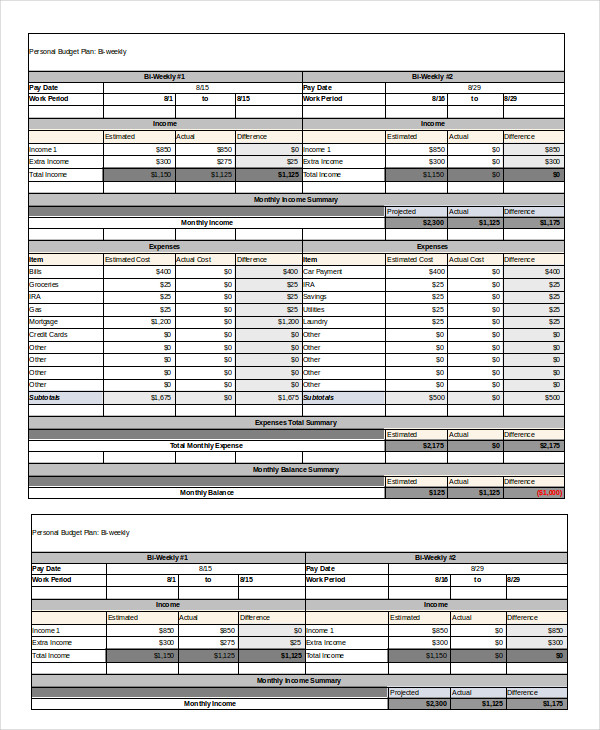

Add a comments row just below the tables. Find the income variance by subtracting the projected annual income from the actual annual income. Find the annual projected and actual income by multiplying your answer in question 1 by 12. First, enter the different type of income and expenses in column A. Do this for both projected and actual monthly income to manage personal finance in Excel. Find the sum of all monthly income sources. Use conditional formatting to highlight how well we are managing our finances. Show tips on how we are doing using logical functions. Find the variance between the actual and project annual income. Compute the projected annual income and actual annual income based on the monthly total. Calculate the monthly income for both projected and actual income. The variance between the budget and the actual expenditure give us the performance indicator of how disciplined we are when it comes to sticking to a budget. The variance between the projected income and actual income gives us the performance indicator of how accurate our estimates are or how hard we are working. Actual expenditure – this is the money that you actually spend buying things. Actual income – this is the actual money that you earn as time progresses. Budget – this is a list of the items that you expect to buy, quantities and their respective prices. Projected income – this is the money that you expect to earn now and in the future. This is a basic personal finance system so we will consider the following components In order to be financially successful, one needs to develop a habit of spending less than they earn and invest the surplus in business ventures that will multiply the invested money Major components of a personal finance system If we do not manage our personal finances properly, then all of our efforts go to waste. To make it even easier to read, you can also shade a few areas. Then, use the borders tool on the workbook’s Home tab (looks like a square divided into four) and choose All Borders. The budget sections are split into the following 12. To make your Excel budget look a little cleaner, select the entire section. We go to school to get a good job, engage in business and other related activities with the main goal of making money. This simple budget planner opens as a spreadsheet that requires access to Microsoft Excel to work. Let’s face it, the world we live in is fuelled by money. Using Excel to set personal budgets, record income and expenses A monthly budget planner, designed to help with planning your monthly spending aligned with your projected budget, contains same categories as a yearly budget. Major components of a personal finance system. In this tutorial, we are going to look at how to use Excel for personal finance to properly manage our budget and finances. It takes discipline to use money properly. Used properly it makes something beautiful- used wrong, it makes a mess!” – Bradley Vinson

0 kommentar(er)

0 kommentar(er)